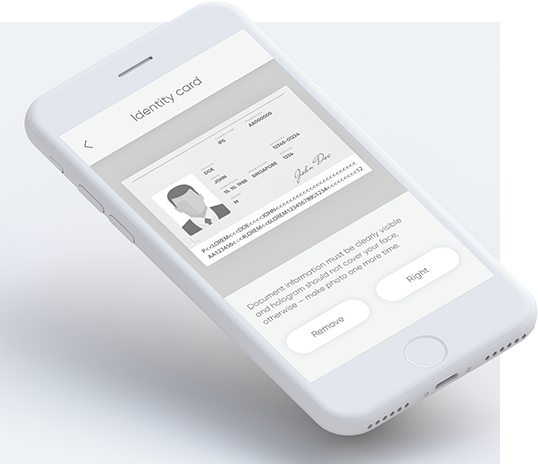

KYC solution

A fully remote KYC is an online identity verification service to avoid fraud and reduce risks when making a financial transaction.

Comply with the KYC and AML requirements and protect your business while increasing acceptance rates.

companies

companies

companies

companies

industry

industry

KYC makes sure your client is genuine and not included on any black lists

The system compares passport authenticity and a person’s biometric verification establishing the identity between physical and digital profiles.

Steps of the KYC process

Comparing a digital photo made on a web-camera online with a passport photo via AI technologies:

- Matching 160 face points.

- Real face validation through 5 million face databases.

- Detection of montage and photo retouching.

- Other types of fraud detection.

Recognition in just 0.5 seconds.

Your client will receive a notification of the verification result and you get a 360° overview of a client in no time!

You can set parameters to activate the KYC process automatically in the following cases:

- high transaction amount;

- frequency of making transactions per day;

- payouts to a client’s bank card and etc.